How do I approve a reimbursement partially?

There may be instances where you cannot approve the whole reimbursement amount, especially when the employee has not submitted sufficient proof. To approve a reimbursement partially:

- Go to the Approvals module.

- Click the reimbursement you want to approve.

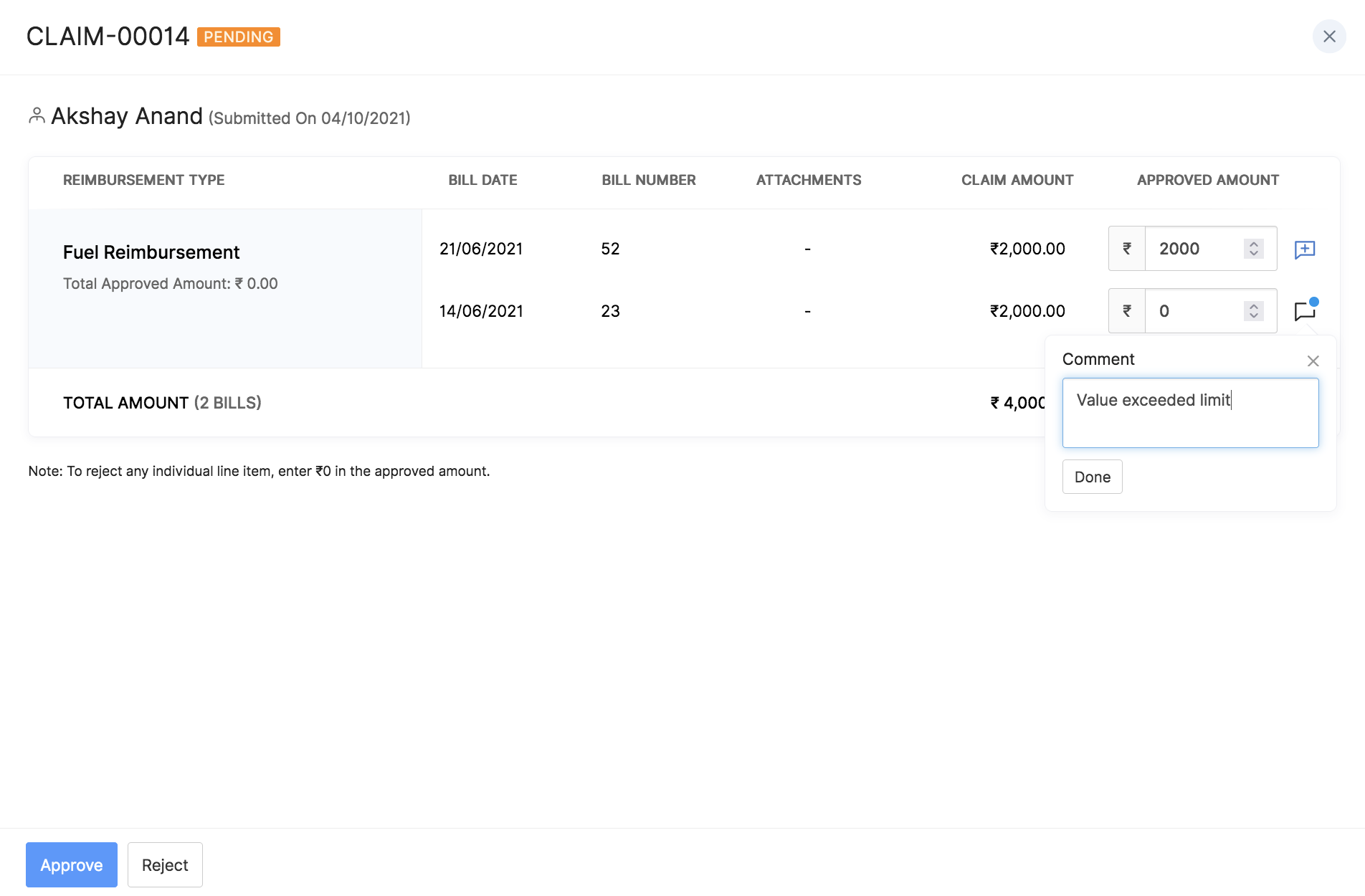

- Under the Approved Amount, enter the actual amount you want to reimburse.

- Next, click the Comment icon next to the amount and enter the reason for the partial reimbursement. Click Done.

- Click Approve.

The reimbursement amount will be processed for the final approved amount.

Related Articles

How can I approve or reject reimbursement claims submitted by employees?

To approve reimbursements, follow these steps: Click Approvals on the left sidebar and select Reimbursements. Click the reimbursement claim you want to review. Enter the Approved Amount. Click Approve to approve the reimbursement claim. If you want ...How do I add comments on claims that I want to reject?

The Comment option next to the reimbursement claim amount allows you to leave a reason for rejecting your employee’s claims. Your employee can view these comments and understand why you’ve rejected their claims. Go to the Approvals module. Click the ...How does the approval process work in Zoho Payroll?

In Zoho Payroll, the approval process involves reviewing and approving various types of requests from employees, including reimbursement claims, proof of investments (POIs), and salary revisions. Here’s how the approval process works for each type: ...How do I review the proof of investments of employees?

To approve proof of investments (POI), follow these steps: Click Approvals on the left sidebar and select Proof of Investments. Click the POI that you want to review. Go through each line item in the POI, enter an approved amount, and click Approve. ...How can I associate TDS Liabilities for my employees?

Once you’ve recorded a challan, you can associate the pending liabilities of employees to the challan of any given period. To associate employees: Go to Taxes and Forms on the left sidebar and click Challans. Switch to the Unassociated tab. Click ...