How to configure taxes for the items I sell?

In Zoho Books, you can configure taxes for individual items. When you create transactions with these item, the configured tax rate will be applied automatically.

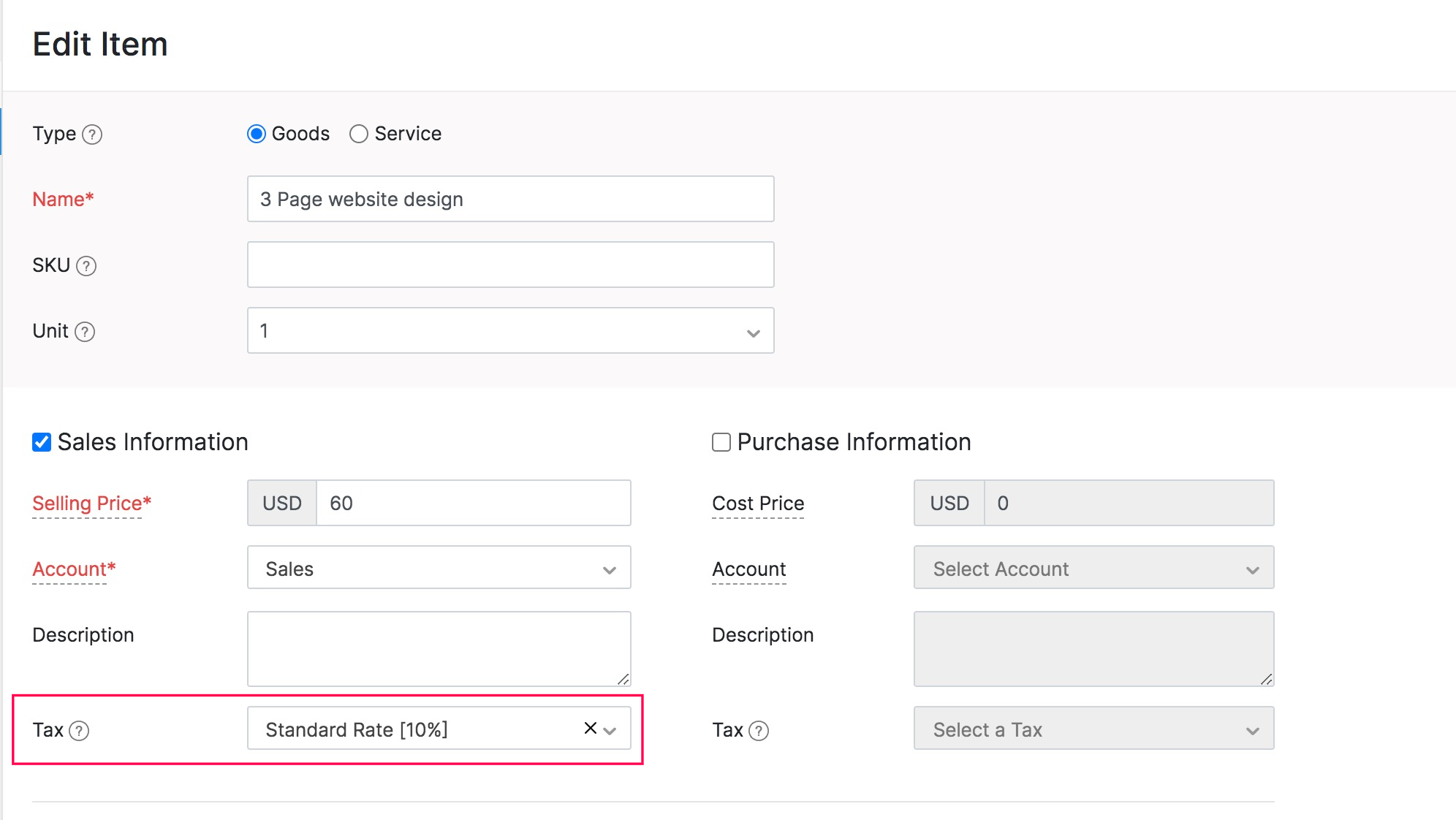

To configure tax for an item:

- Go to Items.

- Create a new item or edit an existing one.

- Select a Tax.

- Click Save.

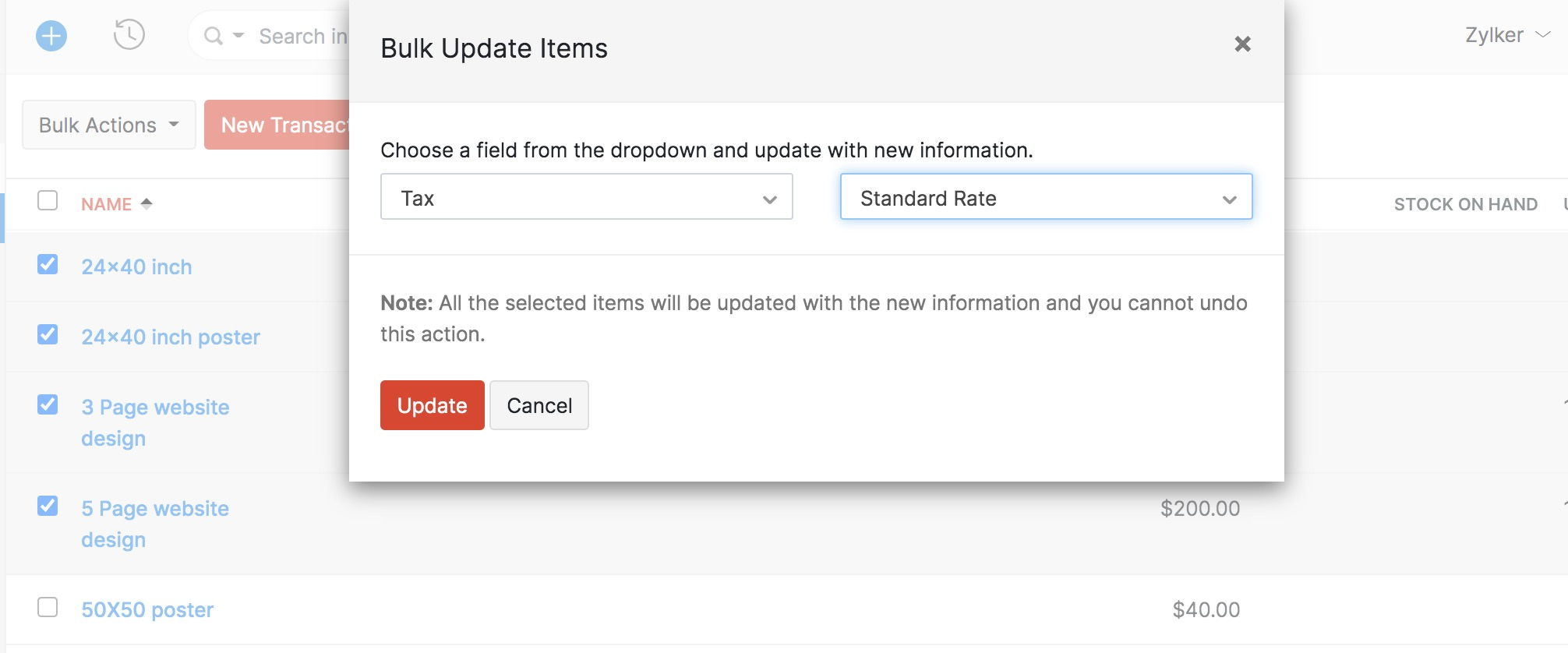

Alternatively, you can update the tax rates of multiple items in one go, using the Bulk Update option. To do this:

- Go to Items.

- Mark the items for which you want to update the tax information.

- Click Bulk Actions > Bulk Update.

- Select the field as Tax and then select the necessary tax rate.

- Click Update.

Related Articles

How can I configure tax deductor details for my organisation?

You can configure your tax deductor details by following these steps. Go to Settings > Taxes. Select the tax deductor’s name from the drop down. The tax deductor must be an employee of your organisation. The tax deductor’s father’s name will be ...How do I configure auto-generation of invoice numbers?

To configure auto-generation of invoice numbers: Click the Settings icon next to Invoice#. Choose to either enable or disable auto-generation. You can configure this while converting a quote into an invoice, or later while editing an invoice. For ...Where can I find my organisation’s AO Code?

AO Code is a combination of Area Code, AO Type, Range Code and AO Number. It can be obtained from the Income Tax office or from your Income Tax account under My Profile. You can update your AO code anytime from Settings > Taxes.How do I include unbilled expenses and projects in an invoice?

When invoicing a customer, you can also include their unbilled expenses and projects in the same invoice. Here’s how: Go to Sales > Invoices. Click + New to create a new invoice. Select a customer. The number of unbilled expenses and projects for ...What is an itemized expense?

An itemised expense would contain multiple expenses listed as line items. You can associate multiple categories and apply different tax rates to each line item. The itemised expense total will be calculated automatically, based on the expense amount ...